If the incorrect amount is withheld from your employee’s paycheck, they could face expensive tax bills or penalties at the end of the tax year.Ĭreate W-2 Form W-2 vs W-4 forms: Knowing the differences

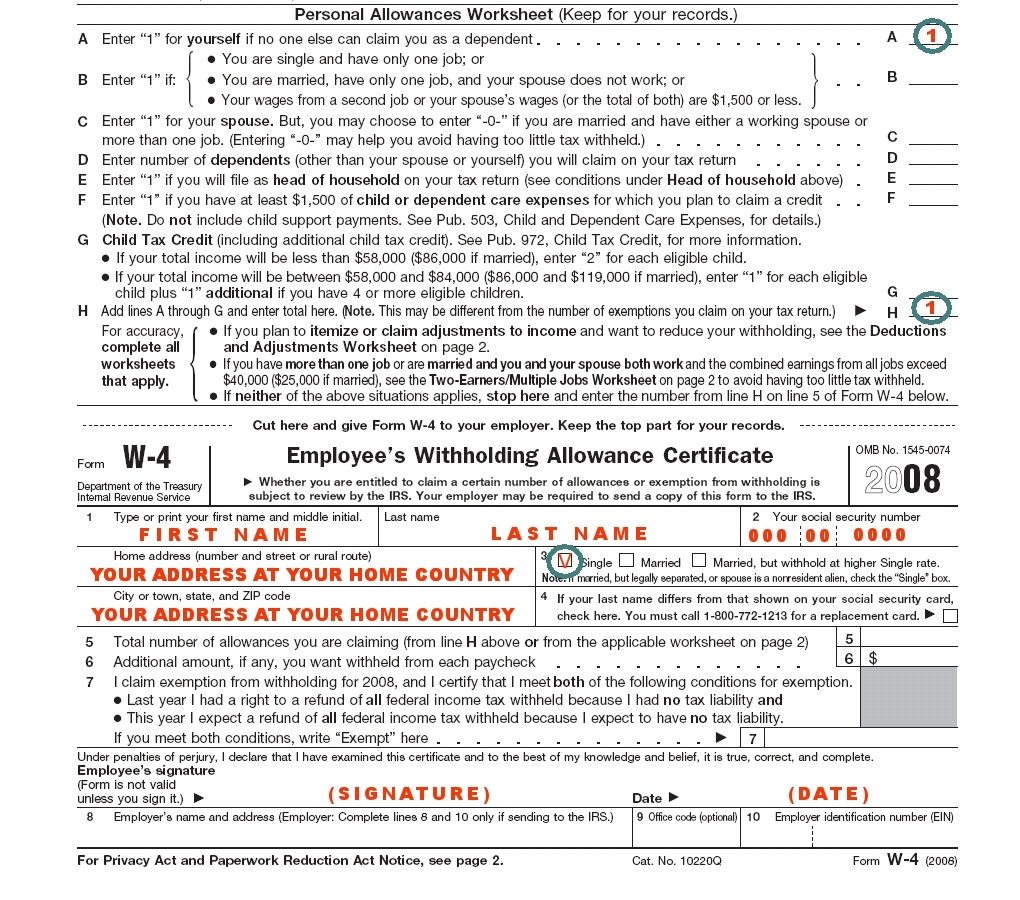

It’s important that the information on the Form W-4 is accurate. This amount will be based on the employee’s wage and the number of withholding allowances they qualify for. Form W-4Īlso known as the Employee’s Withholding Allowance Certificate, the W-4 is a form that the federal government requires employees to fill out when starting a new job.įor an employer’s purposes, an IRS Form W-4 is used to determine the amount of income tax to withhold from an employee’s paycheck.

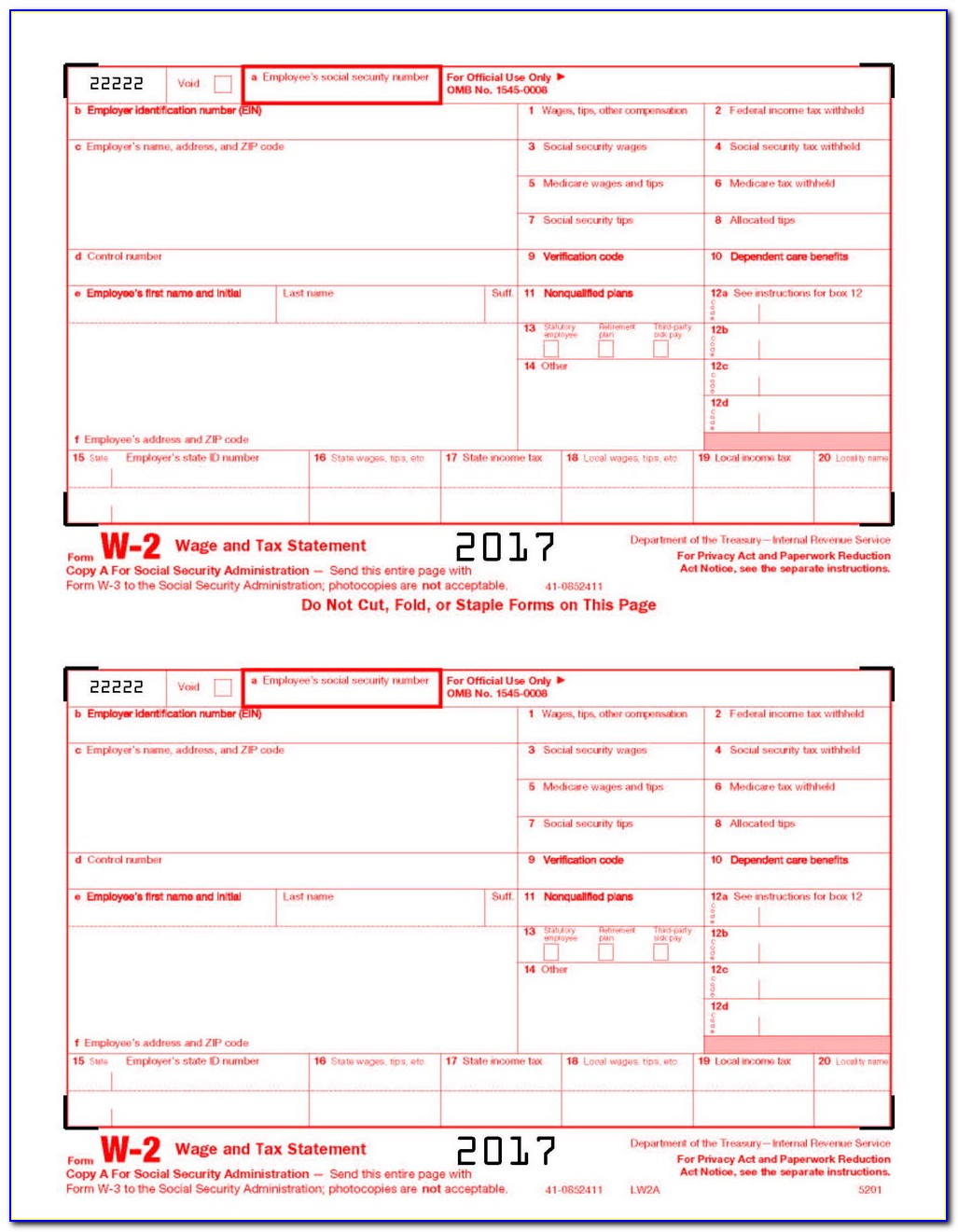

Let’s take a closer look at the basics of each of these tax forms. Once business owners know what W-4 and W-2 forms are, understanding their differences and filling them out becomes much easier. This article will explain why W-4 and W-2 forms are necessary, how to identify and complete each one, and what the options are for submitting them on time. This is especially true for a small business without a large payroll department. However, knowing what each form’s requirements are and the differences between them can be challenging. To avoid unwanted Internal Revenue Service (IRS) penalties, it’s important that employers complete W-4 and W-2 forms at the end of each tax year.

0 kommentar(er)

0 kommentar(er)